Can you believe the year is more than half over? Crazy, but true. In fact there is less than 24 weeks until Christmas. Will you be ready for the holiday shopping with money you have set aside for that purpose? Hopefully your answer is yes; using credit cards to finance Christmas is not a good plan; we know because we used to do that years and years ago. Not a good plan.

We use our 52 Week Saving Challenge money for our holiday shopping and party hosting budget, and it works like a charm. Are you part of team saving?

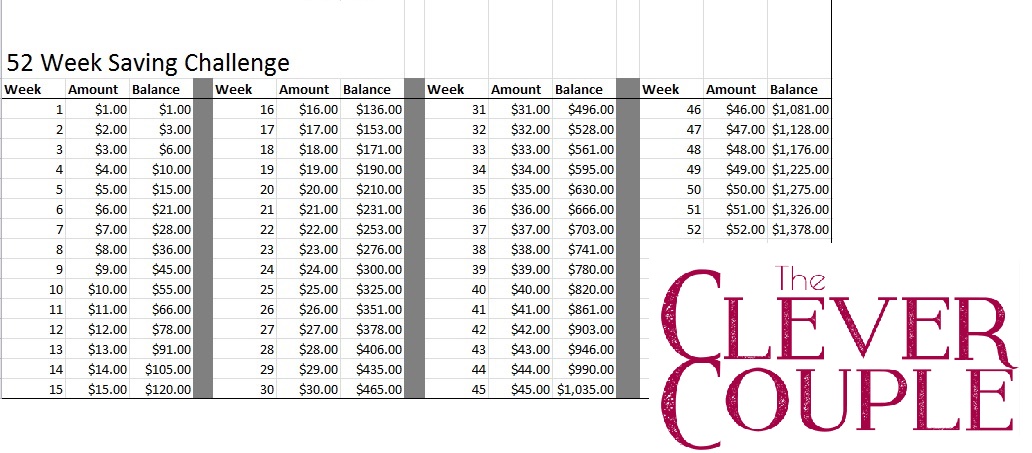

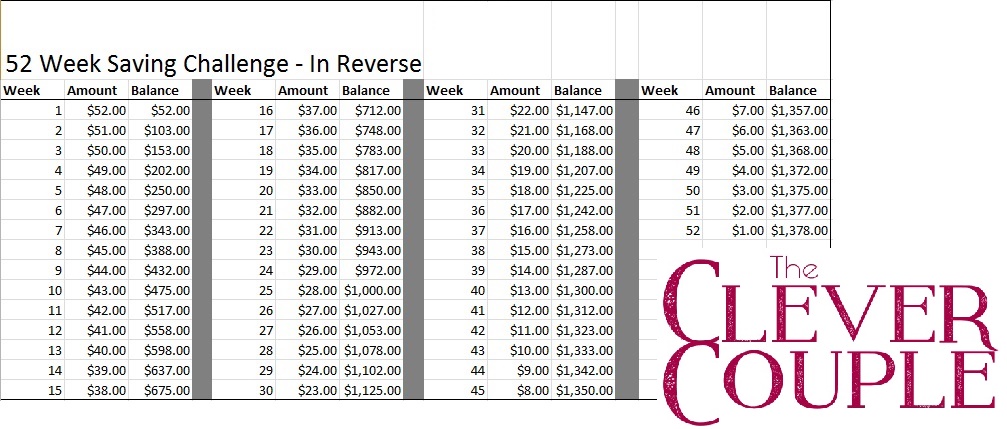

Imagine $1378 sitting in a bank account, earmarked for whatever you wish (maybe a vacation, maybe holiday gift giving, maybe a home remodeling project, maybe towards a new car, the list could go on and on). The idea is simple, participants deposit a pre-determined amount of money into a separate bank account. This money is to remain untouched during the entire 52 weeks; if you stick to the plan you will have $1378 when we are finished.

We’ll post weekly reminders for you when it is time to make the deposit, usually on Friday. The beauty of the program is that you can make small adjustments so that it works for you. If you happen to be paid every other week, maybe twice a week deposits would work best? You are in control of the plan; just be sure you get in the habit of making those deposits. We promise that you will be so grateful at the end of the 52 weeks when you have that wad of cash staring you in the face!

How to be part of the 52 Week Saving Challenge

Step 1

Decide where you will deposit your money. This could be any bank account you have. (We like to use an online bank account that is linked to a debit card because “out of sight” works for us. We use the 100% no fee Capital One 360 card, you can get a free account here. This is NOT a credit card!!) You can also keep the money at home in a bank, or maybe in an envelope. Whatever works for YOU.

Step 2

Commit to the plan.

You have two options with the 52 Week Saving Challenge:

A) Work the plan the traditional way starting with a $1 deposit on week #1, $2 deposit on week #2 and so on. This is the traditional plan and your deposits will increase as the year goes on. Keep in mind as a result this means you will be making the largest payments in December (when most of us have added expenses in the budget already).

B) Work the plan backwards with a $52 deposit on week #1, $51 deposit on week #2 and so on. This means you will be making the largest deposits right off the start but come December you will only be depositing a total of $10 for the final 4 weeks.

We prefer to work the plan backwards.

Step 3

Make the deposit.

Log into your bank, pull out your envelope or create the free online Capital One 360 account and make that deposit.

This is week 28; deposit $28 or $25 if you are working the backwards plan. (If you missed last week because we forgot to remind you – you need to deposit $27 for week 27. If you are working backwards then it would be $26 for week 26.)

You can do this – you can do this! What do you have to loose, right?

Here are some graphics to get you excited about how the funds in your account will grow:

Traditional 52 Week Saving Challenge deposit schedule

Backwards 52 Week Saving Challenge deposit schedule

So far 2017 has been pretty darn amazing, and we are so happy you have made the commitment to save money. Pat yourself on the back – you have earned that.

This is week 28; deposit $28 or $25 if you are working the backwards plan. (If you missed last week because we forgot to remind you – you need to deposit $27 for week 27. If you are working backwards then it would be $26 for week 26.)