Our journey through FPU, Financial Peace University, is nearly over. This weekend we attend our last class, week 9.

What an amazing, life changing journey this has been for the both of us. We are handling money in a totally different way, budgeting (which isn’t a bad thing and does not mean we are not free to have fund and enjoy ourselves) and being intentional.

It has truly changed our lives and we are so excited for our future!

“Live like no one else so later you can live like no one else” is what Dave says all the time and it is true.

During our Financial Peace University journey we have given you weekly summaries of each class because we want to impress on you the major life changing benefit taking FPU has brought us. We want the same for you, if you are ready to make a change.

Find out more about FPU here, find a local class or take the class online.

FPU Recap – week 8

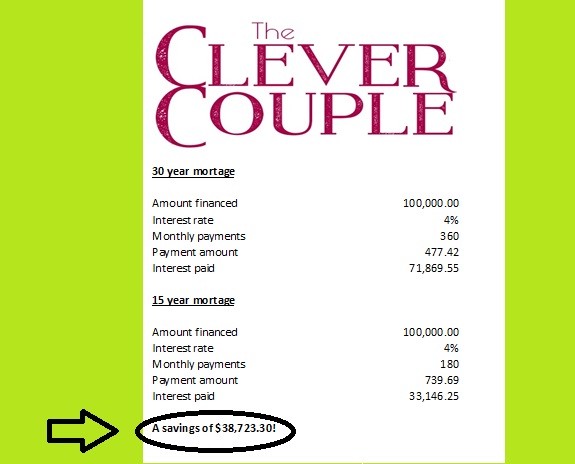

Week 8 was all about mortgages and real estate; most of you probably have a mortgage or will have one some day. Dave did an excellent job of discussing the different types of mortgage options and explaining that he only recommends a 15 year fixed rate mortgage. We know from experience that most lenders will try to get you to enter into a 30 year mortgage which typically carries a higher interest rate and lower monthly payment. Don’t fall for it! The amount of additional interest you will pay on a 30 year mortgage vs. a 15 year mortgage is enormous.

Here is just an example, showing how you will pay $38,723.30 more for your home if you opt for a 30 year mortgage, assuming you finance $100,000 at 4% interest rate:

You can use Dave Ramsey’s online mortgage calculator to help you decide what you can afford and to see the difference going with the 15 year mortgage will make for you.

We didn’t have this knowledge when we bought our home and we are now in the midst of a 30 year mortgage, at an interest rate of 6.625%. Yuck! Right now the interest rates are at some of the lowest points they have ever been so it is a prime time to refinance your existing mortgage into a 15 year fixed rate plan. We are starting to explore that situation and are working with Churchill Mortgage, which is the company Dave Ramsey recommends. We’ve only dipped our toe into the process, but hopefully if all goes as planned we will be able to refinance and start saving money within a few months. Not only does going to a 15 year mortgage shave off 3 years of our payoff time, but we will save tens of thousands of dollars in interest. Hooray for that! And hopefully we will be paying off the mortgage (either the new one or the existing one) EARLY anyway!

If you want to find out more about Dave’s plan for real estate and mortgage, check out all the real estate articles on DaveRamsey.com.